Your financial requirement may not always be ready, especially when you need it the most. Thankfully, we live in an era where online loan options are becoming popular due to their easy and quick process time. But what if you are someone with no credit history or score? Well, some lenders can provide loans without assessing the borrower’s score or history. Such a type of loan is called a No credit check loan.

No credit check loans from iPaydayLoans can help you finance your purchase, start a small business, or come in handy when you need extra cash. Getting access to quick funds in the present era is challenging. Hence, iPaydayLoans connects borrowers like you to reputable lenders in a few minutes.

What is a no-credit-check loan?

No credit check loan is a loan that doesn’t involve conducting a depth-search of credit history and score by the lender to approve your loan application. iPaydayLoans offers borrowers an intuitive and user-friendly platform where in a few clicks can apply for a loan online and get access to quick funds provided they meet the required criteria. iPaydayLoans offers No credit check loans to borrowers who need instant money but whose credit score is very low. Yet, note that different vendors charge varying interest rates. Also, they have higher interest rates than usual loans.

No credit check loan is a good option when someone needs cash for unavoidable circumstances such as medical surgery or repair work. In this loan type, the lender doesn’t investigate the borrower’s credit score or years of credit report before approving the application.

Rather than a credit history, they often need personal details like employment that indicate the borrower’s ability to repay the loan. It can be any document like a payslip, bank statement, or any other proof of income, or previous loan details like a school loan or car loan. Hence, if you wish to apply for a loan online, keep reading this post on how to apply.

Features of No Credit Check Loans By iPaydayLoans

Here are a few features of no-credit-check loans by iPaydayLoans.

- No credit score is evaluated before sanctioning loan by the lender

- Minimal paperwork and documentation

- Flexible repayment

- Higher loans are sanctioned according to requirements by the lender

- High-interest rates

The Benefits Of No Credit Check Loans iPaydayLoans

- The loan can be approved instantly

- Access to funds even with a low credit score

- Minimal documentation is done

- Less risk of getting the application rejected

- Loan approval time is less

How Does iPaydayLoans Work?

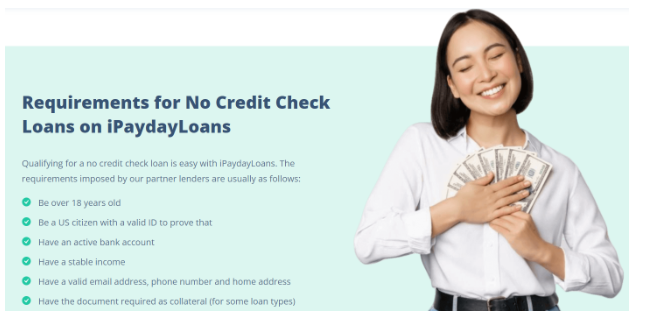

Applying for a no-credit-check loan is easy with iPaydayLoans. You can visit our website and then submit the application form. The application can be accepted within hours of applying and you will get access to a range of lenders ready to offer you an amount. After you accept the terms and conditions of a particular lender, then you can expect the fund to get credited within 24 hours.

To get loan approval from the lender, individuals need to provide bank account and employment information that helps them to verify income. Lenders use this information, along with previous payment and credit history, to calculate loan amounts if your application is approved. Don’t worry, your personal information is always safe with iPaydayLoans.

Steps To Apply for Loan with No Credit Check Online-

Below mentioned are steps to follow to apply for a loan with no credit check in general-

- Search online for loan lenders. Prepare a list of lenders who offer loans with no credit check and who meet your criteria.

- Once you are done with preparing a list, the most important thing is to compare. Compare lenders in your list to know their terms and conditions and which suits your needs the most. Make sure you go through the TnC of every lender carefully.

- Fill out the loan application form on their website and provide the required information such as personal information, income proof, necessary details, etc.

- Keep your documents ready to speed up the process. Some lenders may want you to submit documents such as proof of income, ID, and bank details. Upload the required documents to complete the online application process.

- Once you finish the application process, wait for approval from a lender. It can take up to a few hours or minutes also.

- Before accepting a loan, make sure to review the terms and conditions. Understand repayment, interest rate, fees, hidden charges, etc., associated with the loan. If you are satisfied with them, then accept the loan. The lender will transfer the amount directly to your bank account.

- Repay the loan as per schedule. It will help you avoid any charges like the late fee or prevent any damage to your credit score.

How to apply for No Credit Check Loans on iPaydayLoans?

iPaydayLoans offers easy access to get in touch with lenders instantly who offer online payday loans. They are short-term loans that can be issued within minutes or hours and help during overlooked circumstances. A payday loan is also known as a cash advance loan, and there are a few things that you must know about it.

Online payday loan at iPaydayLoans is to be returned with the forthcoming paycheck. They generally last for two weeks. The short-term period of payday loans often comes with higher interest rates. They are a good option for individuals with low credit scores.

With iPaydayLoans, you won’t have to struggle to find the right lenders or use numerous other sites to compare lenders, interest rates, or their credibility. We have done everything for you and by submitting a few information, you will get quick access to funds, and everything for free! Just remember to repay the loan on time, or it may affect your credit score further.

Conclusion

iPaydayLoans will help you get a loan within a few hours, and funds can be received in the account on the same business day. You can apply for a loan with no credit check on iPayday by sitting in comfort from your home and at any time. The platform will help you to connect with renowned lenders across the United States, which will help you with various secure loan solutions. Before you accept a loan, read the terms and conditions thoroughly to avoid unavoidable charges and repay your loan as per the scheduled repayment to prevent damage to your credit score.